Should executive’s variable compensation be indexed to the CSR criteria?

Published on 10/15/2020

Thematics :

Published on 10/15/2020

The purpose of this article is to assist you in developing an informed and completely disinterested opinion about this increasingly common governance lever in companies. Without any ethical or political consideration, you will find in a three-question format with a focus on France, a summary of recent research offering different insights into the subject.

Academics and practitioners have bandied this question back and forth for decades. According to the school of thought called “fundamentalist” represented by Milton Friedman (1970), a company is a structure whose sole purposes is to increase profits for its shareholders. Since then, ethical conventions have significantly changed. In 2018, Maison des Tendances and BNP Paribas Fortis conducted a survey involving 640 Belgian companies, which resulted in two main observations. First, the majority of companies (68%), and especially the largest of them (73% versus 66% for SMEs) believe that “CSR is essential for surviving in a constantly changing environment,” while a small portion of them think that CSR is only useful for their image (23%) or that it is merely a fashionable phenomenon (13%). For 75% of the companies surveyed, CSR is seen as a profitable investment or a winning strategy rather than an economic cost because it can “motivate employees, attract new talent, win over customers and reduce costs.”

Working with 2,200 academic studies, the authors of a recent study from 2015 [efn_note]Working with 2,200 academic studies, Friede et al. (2015) drew up a summary of the 2,200 academic studies using a meta-analysis to arrive at the results noted in this article.[/efn_note]consider that CSR investments are fully justified from a financial standpoint because 90% of the analysed studies highlight a non-negative link, the majority of which underscore a positive link, between social and financial performance. Moreover, the authors of these studies have seen stability in this positive link since the mid-90s.

Taking into account this kind of criteria has several advantages:

It can be used in receiving the support and participation of top managers without whom the implementation of a CSR policy would not be effective[efn_note]See Daily and Huang (2001), Dechant and Altman (1994), Berrone P. and Gomez-Mejia L. R. (2009), Delmas et al. (2011)[/efn_note].

A study[efn_note]See Flammer et al. (2018)[/efn_note] done in 2018 shows that taking into account CSR criteria helps companies in the S&P 500[efn_note]The S&P 500 is a market index based on 500 large companies listed on the U.S. markets. It covers about 80% of the American stock market by its capitalisation. It overtook the Dow Jones Industrial Average as the most representative index for the American stock market because it is made up of the largest amount of companies and its value takes into account the stock capitalisation of the companies in the index[/efn_note] index to make greater strides into the future, intensify social and environmental initiatives, reduce greenhouse gas emissions and promote green innovation for products and patents.

Indexing executive compensation to CSR can create value for the company and its shareholders. Several recent studies[efn_note]Particular Hong et al. (2016)[/efn_note] show that shareholders view the practice of indexing as a strategy for creating value rather than a cost component.

A 2018[efn_note]See Flammer et al. (2018)[/efn_note] study underscores the fact that this practice can be used to increase the company’s value (on the basis of the measurements using the Tobin’s Q coefficient[efn_note]The basic idea of this model is as follows: the entrepreneur invests in new projects if the market values them above what they cost. The investment is profitable and as long as the value of company growth remains greater than its cost.

James Tobin proposed a ratio, called the Q Ratio, between the company’s market value and its replacement costs. In effect, under the stock market efficiency hypothesis, the market value of a company is exactly equal to the discounted sum of its future profit flows. A Q Ratio greater than 1 shows that the market expects a return on investment greater than its costs. Conversely, if the Q Ratio is less than 1, the market anticipates a return on investment lower than its cost. In this latter case, the shareholders’ best interest would be to sell the existing assets at their replacement cost. If this is impossible, they should at least make no further investments and gradually amortize the existing capital.

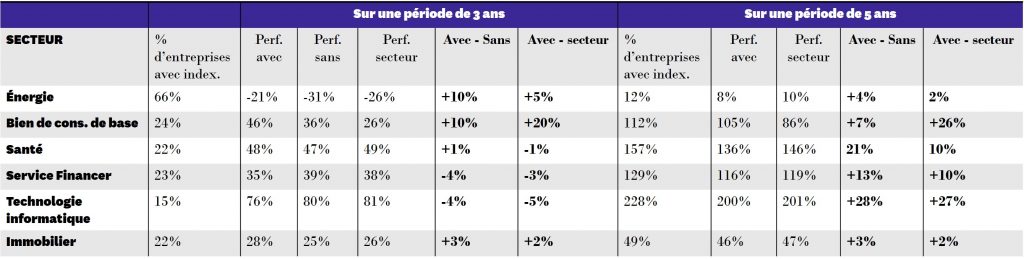

[/efn_note]). A study conducted by Deutsche Bank (2017) compares the stock performance of companies with a compensation plan indexed to ESG criteria (Environment, Social and Corporate Governance) with those of companies that do not have one. To avoid any sectorial bias, the comparison was done sector by sector. Among the 11 sectors studied, outperformance was observed in six sectors: energy, basic consumer goods, health, financial services, IT technologies and property.

Table : Market outperformance of companies with a compensation plan indexed to ESG criteria

Lastly, the integration of CSR criteria can cause changes to the compensation system, which is one of the key mechanisms in company governance. Compared with existing tools, this new instrument is no longer limited to the interests of financial partners, as it now extends to the interests of all of the stakeholders in the broadest sense, which are for example society or the environment.

In Europe, France is the country where variable compensation is most often used. In fact, the percentage of companies with variable compensation plans rose to 51% versus 28% in the United Kingdom and 12% in Germany[efn_note]See: Crevel (2009)[/efn_note].

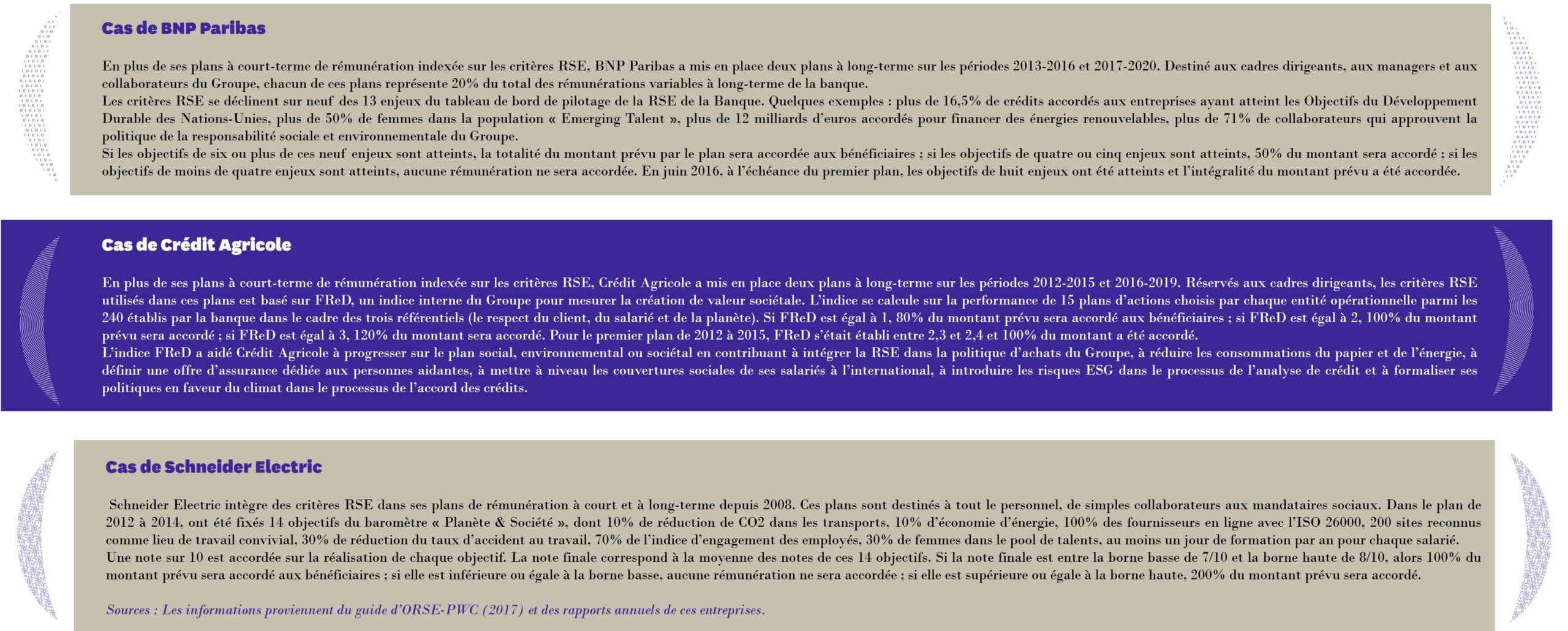

A joint report from 2017 by the French Observatory for Corporate Social Responsibility (ORSE) and PWC[efn_note]In a report from 2012 titled “Study on the integration of the CSR criteria in the variable compensation of executives and managers”, published jointly in 2012 by the French Observatory for Corporate Social Responsibility and Pricewaterhousecoopers (PWC). It was updated in 2017 as a practical guide.[/efn_note] underscores certain characteristic traits of the French practice. This study brought to light the widespread use of this practice in the CAC 40 where the percentage of companies with this instrument in place rose from 10% in 2006 to 73% in 2015.

Among the companies adopting this practice, indexing compensations to CSR criteria seems rather low. In fact, for 70% of companies the amount of bonuses does not depend on meeting objectives[efn_note]See Glass Lewis (2014)[/efn_note]. The consequence of this lack of relationship and substance is that it weakens the effectiveness of this tool[efn_note]See Westphal and Zajac (1994), Zajac and Westphal (1995)[/efn_note]. Additionally, there is a clear expectation for transparency on the subject since only 54% of companies provide information on the criteria and their integration method and just 13% of them specify the expected performance level for these criteria.

To promote these actions, the integration of the CSR criteria into the variable compensation plans seems to be an effective tool. This practice presents particular value for companies that have a significant impact on the environment for those undergoing profound transformation. Generally speaking, such practice can play a positive role for reinforcing social stability by improving the well being of the company’s employees.

Further information:

Several examples of the practice by companies in the CAC 40 index are shown in the table below.